This blog was written by John D. Wilson, former Deputy Director for Regulatory Policy at the Southern Alliance for Clean Energy.

Guest Blog | January 30, 2018 | Energy Policy, Utilities

Beginning in 2011, the Tennessee Valley Authority, the largest government-owned utility in the country, began cutting cutting rates for industrial customers. This wasn’t publicly discussed by TVA except as part of a rate restructuring in 2015. TVA hasn’t promoted its rate cuts publicly since then.

According to a recently-published Synapse report, thanks to these breaks from TVA, industrial customers saved $1.4 billion from 2011-2016, compared to the average rate trend for all customers. As illustrated below, industrial customers served by TVA’s local power companies pay only 6.3 cents per kilowatt-hour (kWh), and industrial customers served directly by TVA pay only 3.9 ¢/kWh.

Yet overall since 2011, TVA’s average price of electricity for all customers has increased by 2%. Residential customers experienced a bigger increase on average: The average price of electricity for residential customers increased from 10.1 ¢/kWh to 10.5 ¢/kWh. Residential customers were the only customer class to experience a net increase in electricity prices over the five-year period.

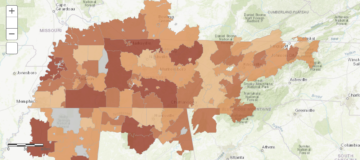

These price increases varied among local power companies (click for pdf with data), and added up to big money: Synapse estimates that in 2016, residential customers paid $429 million more than if the rate increase had been shared equally. In other words, each residential customer on the TVA system paid an average of $110 in 2016 due to electricity price changes made since 2010 to favor industrial customers.

As if giving rate cuts to large corporations while prices for families and other households were going up isn’t enough, TVA’s executive team is now preparing to ask its Board for approval to make even more big changes to its electric power rates. These changes will likely increase TVA’s potentially illegal preference for industrial customers over residential customers, discourage customers from installing and using solar power, and even make it harder for customers to manage their own power bills by saving energy.

How did this happen? Why didn’t the pubic know? These are questions that SACE and our allies at NAACP and Friends of the Earth, including former TVA Board Chairman David Freeman, are seeking to answer.

Is TVA Following the Law?

The TVA Act was passed in 1933 as part of the New Deal. As former TVA Board Chairman David Freeman knows and often explains, President Franklin Roosevelt and Congress intended that TVA’s electric power projects should be “primarily for the benefit of the people … particularly the domestic and rural consumers.” (See Sec. 11 on p. 13 of the TVA Act.) Furthermore, copies of contracts between TVA and some local power companies demonstrate that TVA has emphasized the preference for “domestic and rural customers” as a general policy.

The TVA Act was passed in 1933 as part of the New Deal. As former TVA Board Chairman David Freeman knows and often explains, President Franklin Roosevelt and Congress intended that TVA’s electric power projects should be “primarily for the benefit of the people … particularly the domestic and rural consumers.” (See Sec. 11 on p. 13 of the TVA Act.) Furthermore, copies of contracts between TVA and some local power companies demonstrate that TVA has emphasized the preference for “domestic and rural customers” as a general policy.

In fact, use by industry is, under the TVA Act, “a secondary purpose.” This is the same law that TVA relies upon to support its mission of economic development. Yet while we strongly support many of TVA’s economic development activities, we do not see any justification for TVA to cut rates for its existing industrial customers to the tune of $110 per household in 2016.

TVA’s 2010 Rate Structure Change Backfired on Residential Customers

We are all to be forgiven if we didn’t see it coming — that TVA was going to increase residential rates to make up for reductions for industrial customers. TVA used its arcane regulatory process, and lack of transparency, to potentially deceive the public. In 2010, TVA published an Environmental Assessment on its rate structure reform. It stated that the purpose of its changes was to “improve opportunities for customers to save money by shifting their power usage from on-peak to off-peak periods (i.e., load shifting).” TVA also claimed that “there likely would be no substantive, disproportionate negative impacts to minority or low-income populations.”

After reviewing many residential rate changes by TVA’s local power companies, it is evident that TVA’s rate changes did pretty much the opposite. While local power companies did adopt rates that change from month-to-month, better reflecting TVA’s actual fuel costs, those changes did not promote “load shifting” (which refers to daily shifts in activities). Instead, since TVA’s local power companies reacted by increasing mandatory fees. The higher mandatory fees actually resulted in reducing, not improving, “opportunities for customers to save money.” Not only has it become harder for any small power customer to save money, but higher mandatory fees make it particularly difficult for TVA’s low-income, minority and other customers with fixed incomes to control their electric bills.

Who are TVA’s VIPs?

In 2015, reporter Dave Flessner broke a story about TVA’s secret VIP rates and economic incentives for new industrial customers. One of TVA’s statutory missions is economic development, and TVA meets that mission by providing training to local communities to help prepare for new industry, services from TVA’s engineering and design professionals, economic research studies … even spending ratepayer money to invest in speculative development of potential sites for new business locations.

In 2015, reporter Dave Flessner broke a story about TVA’s secret VIP rates and economic incentives for new industrial customers. One of TVA’s statutory missions is economic development, and TVA meets that mission by providing training to local communities to help prepare for new industry, services from TVA’s engineering and design professionals, economic research studies … even spending ratepayer money to invest in speculative development of potential sites for new business locations.

TVA’s programs go well beyond training, assistance, and free site prep, offering financial subsidies, including credits to monthly power bills, grants to companies, low-interest loans, and even waivers of security deposits for large customers. But as the Chattanooga Times Free Press story reported, details about “nearly $500 million of discounted rates” were denied to reporters, just as TVA has stonewalled our requests for information about how it has and plans to set rates for all customers.

In spite of these impressive discounts, TVA President Bill Johnson told Dave Flessner that TVA’s “cost-of-service studies” prove “It doesn’t really cost any of the other customers of TVA anything.” But as the Synapse report points out, TVA only discloses the secret “cost-of-service studies” with its local power companies and large corporate customers.

Furthermore, TVA is not accountable to any regulatory oversight for its rate studies. For large investor-owned utilities, states regulate the rates. Similar studies for most other large utilities in the Southeast are routinely reviewed, and I’ve read these studies in several rate cases. For municipal utilities, the city council should have access to the studies and supervise the rates. But for TVA, there is no state or federal agency with the authority to exercise oversight over its rate studies.

It also remains unclear whether TVA’s VIP treatment of new industrial companies are part of the overall industrial rate cut. Based on how TVA describes some of its credits, grants and loans, these financial benefits may be paid for out of TVA’s overall budget. Without clear explanations from TVA, we don’t know whether TVA is effectively meeting its economic development goal, or whether TVA is going too far and favoring industrial customers at the expense of residential customers.

Keeping it Secret

But why haven’t you heard about these changes from the nation’s largest federal government owned, monopoly utility?

You haven’t heard because TVA is going to great lengths to keep this secret.

- In August, TVA took comment on its proposal to exempt rate structure changes from public review. Because TVA is a federal agency, the only federal law that requires it to consult with the public is the National Environmental Policy Act. Otherwise, the TVA Act leaves it to TVA management to decide what public hearings are “appropriate.” Since TVA has proposed to exempt these discussion from public review, we expect TVA to exempt the next Board of Directors action to change rate structures from extensive public review.

- TVA is meeting secretly with a group it calls the “Tennessee Valley Customer Planning Council.” TVA uses this secret group in its “decision-making process” to work with the Tennessee Valley Public Power Association and the Tennessee Valley Industrial Council. TVA hasn’t disclosed who is on this council or what this group has been discussing. TVA is also meeting privately with other selected audiences that it believes will support its agenda.

- On October 26, 2017, after TVA refused to explain its past decisions and future plans to shift rates away from industrial customers and increase mandatory fees for its residential customers, SACE began requesting information from TVA using the Freedom of Information Act. TVA has withheld responses to these requests.

While the decline in industrial rates dates back to at least 2011, the pace of rate cuts picked up in 2015 and 2016. This coincided with TVA’s second public change to its rate structures, as described in a 2015 Environmental Assessment. While the 2010 rate structure reform claimed that “households and businesses within a customer class would be affected uniformly,” the 2015 rate structure reform openly stated that one of TVA’s purposes was to, “Improve the competitiveness of industrial rates.”

However, TVA grossly underrepresented how drastically industrial rates would fall. According to its 2015 assessment, TVA expected its new rate structure would drive residential rates up by about 0.4 %, while industrial and large commercial customers benefited from rate cuts of 1.7 – 3.6 %. Yet for 2016 (the first full year under the new rate structure), residential rates went up 2 % and commercial rates went up 1 %, but industrial rates went down by over 7 %. For the last two years of TVA’s industrial electricity price cut, industrial rates dropped about twice as much as TVA had projected.

Here’s the bottom line: Under TVA President Bill Johnson, TVA has gradually shifted away from fair and transparent rates to the detriment of residential customers – and residential customers are, by law, TVA’s most important customers. Today’s report release raises a lot of questions about how TVA is treating its residential (and small commercial) customers that neither we nor Synapse can fully answer. Both the questions and the difficulty in getting answers can be traced back to how TVA has managed rates over the past seven years.